b-entreprises.site Search Listings

Search Listings

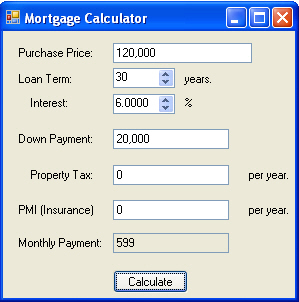

Mortgage And Rent Calculator

To support our service, we display Private Sponsored Links that are relevant to your search queries. These tracker-free affiliate links are not based on your personal information or browsing history, and they help us cover our costs without compromising your privacy. If you want to enjoy Ghostery without seeing sponsored results, you can easily disable them in the search settings, or consider becoming a Contributor. The other 50% can be used to pay the monthly mortgage payment. This can be used to quickly estimate the cash flow and profit of an investment. 1% Rule—The gross monthly rental income should be 1% or more of the property purchase price, after repairs. . This deposit is usually equal to one month's rent and covers any damage the tenant causes to the property. Upfront costs are the costs you'll need to pay before moving into your new home, including your down payment, closing costs, and other fees. Calculate your monthly mortgage payment. . General inflation rateThis is how much prices increase year over year. We use it when calculating future expenses, such as home insurance, home repairs, and utilities. Renting will always cost less. You could save about $0/month. Abby Badach Doyle is a home and mortgages writer for . The cap rate does not include financing based on non-mortgage expenses and income. To calculate the cap rate, you divide the net operating income (NOI) by the price or current market value of the property. . In the U.S. today, homeownership is as American as bald eagles and hot dogs. Moreover, the federal government offers tax incentives for owning a home, a strong reason not to rent. Furthermore, many believe that mortgages build equity. . Home equity is the market value of the rental property minus any outstanding balances owed. If you took out a mortgage to finance the purchase, you’d subtract the remaining loan principal from the initial loan principal and add the balance to the total down payment amount. . These are some of the most important and they’re the only ones we can’t estimate for you. A very important factor, but not the only one. Our estimate will improve as you enter more details below. Setting a target rent allows for a direct comparison of potential costs. Buying tends to be more appealing the longer you stay because the upfront fees are spread over many years. The calculator assumes you have a fixed-rate mortgage . Easy to use rental mortgage calculator for mortgage rates for investment property. Whether you are a new or experienced real estate investor, our rental property investment calculator can help you assess the profitability of potential investments and make sound, informed decisions. . The interest rate identified in the estimated monthly payment and APR example is not indicative of current market rates and is for educational purposes only. The estimated monthly payment and APR calculation are based on borrower-paid finance charges of % of the base loan amount. . In real life, you would have to pay interest charges on the mortgage, and there is one additional factor in the equation: the dollars you receive in future rent payments may or may not be more valuable than today's dollar. The income approach can go into minute detail for precise calculations. . If you enjoy Ghostery ad-free, consider joining our Contributor program and help us advocate for privacy as a basic human right.

Use Our Comparison Site & Find Out Which Lender Suits You Best. Skip the Bank & Save!

The other 50% can be used to pay the monthly mortgage payment. This can be used to quickly estimate the cash flow and profit of an investment. 1% Rule—The gross monthly rental income should be 1% or more of the property purchase price, after repairs. This deposit is usually equal to one month's rent and covers any damage the tenant causes to the property. Upfront costs are the costs you'll need to pay before moving into your new home, including your down payment, closing costs, and other fees. Calculate your monthly mortgage payment. General inflation rateThis is how much prices increase year over year. We use it when calculating future expenses, such as home insurance, home repairs, and utilities. Renting will always cost less. You could save about $0/month. Abby Badach Doyle is a home and mortgages writer for. The cap rate does not include financing based on non-mortgage expenses and income. To calculate the cap rate, you divide the net operating income (NOI) by the price or current market value of the property. In the U.S. today, homeownership is as American as bald eagles and hot dogs. Moreover, the federal government offers tax incentives for owning a home, a strong reason not to rent. Furthermore, many believe that mortgages build equity. Home equity is the market value of the rental property minus any outstanding balances owed. If you took out a mortgage to finance the purchase, you’d subtract the remaining loan principal from the initial loan principal and add the balance to the total down payment amount. These are some of the most important and they’re the only ones we can’t estimate for you. A very important factor, but not the only one. Our estimate will improve as you enter more details below. Setting a target rent allows for a direct comparison of potential costs. Buying tends to be more appealing the longer you stay because the upfront fees are spread over many years. The calculator assumes you have a fixed-rate mortgage. Easy to use rental mortgage calculator for mortgage rates for investment property. Whether you are a new or experienced real estate investor, our rental property investment calculator can help you assess the profitability of potential investments and make sound, informed decisions. The interest rate identified in the estimated monthly payment and APR example is not indicative of current market rates and is for educational purposes only. The estimated monthly payment and APR calculation are based on borrower-paid finance charges of % of the base loan amount. In real life, you would have to pay interest charges on the mortgage, and there is one additional factor in the equation: the dollars you receive in future rent payments may or may not be more valuable than today's dollar. The income approach can go into minute detail for precise calculations.